Step into the realm of Insider Secrets: How to Maximize Your Travel Insurance Coverage for Peace of Mind, where seasoned travel enthusiasts unveil their insider knowledge. Embark on a journey of discovery as we delve into the intricacies of travel insurance, empowering you to safeguard your adventures with confidence.

Within these pages, you’ll uncover the essential elements of travel insurance coverage, from medical expenses to trip cancellations and lost luggage. We’ll navigate real-life scenarios, highlighting the invaluable role of understanding policy terms and conditions. Together, we’ll explore strategies for selecting the ideal policy, maximizing coverage options, and negotiating with insurance providers to ensure your peace of mind.

Coverage Essentials

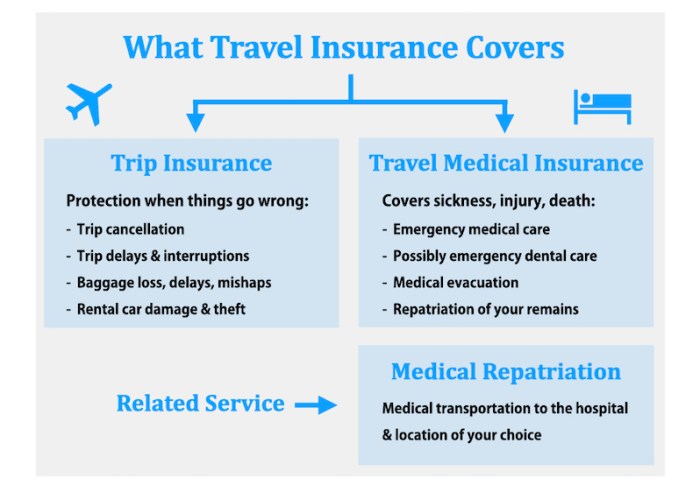

Travel insurance is designed to provide financial protection and peace of mind when you travel. It can cover a wide range of unexpected events, such as medical emergencies, trip cancellations, and lost luggage.

Understanding the different types of coverage available is essential to choosing the right policy for your needs. Here are some of the most common types of travel insurance coverage:

Medical Expenses

Medical expenses coverage reimburses you for medical expenses incurred during your trip, such as doctor visits, hospital stays, and emergency medical transportation. This coverage is especially important if you are traveling to a country with limited or expensive healthcare.

Trip Cancellation

Trip cancellation coverage reimburses you for the non-refundable costs of your trip if you have to cancel your trip for a covered reason, such as illness, injury, or a natural disaster. This coverage can provide peace of mind in case you have to cancel your trip unexpectedly.

Lost Luggage

Lost luggage coverage reimburses you for the value of your luggage and personal belongings if they are lost, stolen, or damaged during your trip. This coverage can help you replace essential items and avoid financial loss.

Importance of Understanding Policy Terms and Conditions

It is important to carefully read and understand the terms and conditions of your travel insurance policy before you purchase it. This will help you avoid any surprises or disputes later on. Make sure you understand the coverage limits, exclusions, and deductibles.

Maximizing Coverage

To ensure optimal coverage, it’s crucial to carefully select a travel insurance policy that aligns with your specific needs. Consider the destinations you’ll be visiting, the activities you’ll be engaging in, and the potential risks associated with your itinerary.

Additionally, explore the benefits of purchasing additional coverage options, such as adventure sports coverage if you plan on engaging in high-risk activities like skiing or rock climbing. Rental car insurance can also provide peace of mind in case of any mishaps while driving abroad.

Negotiating with Insurance Companies

Don’t hesitate to negotiate with insurance companies to maximize your coverage. Explain your travel plans and any specific concerns you may have. By presenting a clear case for your needs, you may be able to secure additional coverage or discounts on your policy.

Claim Process

Filing a travel insurance claim can seem daunting, but it doesn’t have to be. Here’s a step-by-step guide to help you navigate the process smoothly.

Once you experience a covered event during your trip, it’s crucial to report it to your insurance provider promptly. Most policies require you to notify them within a specific time frame, typically 24 to 48 hours.

Essential Documentation

When submitting your claim, include the following essential documentation to support your request:

- Completed claim form

- Copy of your travel insurance policy

- Proof of loss or damage (e.g., receipts, police reports, medical records)

- Travel itinerary and boarding passes

- Documentation of expenses incurred (e.g., receipts, invoices)

Common Reasons for Claim Denials

To avoid potential claim denials, be mindful of the following common reasons:

- Uncovered event:Ensure the event you’re claiming for is covered under your policy.

- Late reporting:Failure to report the incident within the specified time frame can result in denial.

- Insufficient documentation:Providing incomplete or inadequate documentation can hinder your claim’s approval.

- Pre-existing conditions:If you have a pre-existing medical condition, it may not be covered unless it’s specified in your policy.

- Fraudulent claims:Any attempt to intentionally deceive the insurance company can lead to denial and potential legal consequences.

Insider Tips

Unlock the secrets from seasoned travel professionals to maximize your travel insurance coverage and safeguard your peace of mind.

Discover strategies to optimize your coverage without breaking the bank and avoid common pitfalls that can compromise your protection.

Saving Money on Travel Insurance

While comprehensive coverage is crucial, saving money on travel insurance is possible without sacrificing protection. Consider these strategies:

- Compare quotes from multiple providers:Research different insurers and compare their policies, coverage, and premiums.

- Increase your deductible:Opting for a higher deductible lowers your premium, but ensure you can afford the deductible amount in case of a claim.

- Bundle your policies:Combine travel insurance with other policies, such as homeowners or auto insurance, for potential discounts.

- Look for discounts:Many insurers offer discounts for AAA members, students, seniors, or military personnel.

- Purchase insurance early:Booking your travel insurance in advance often results in lower premiums.

Common Pitfalls to Avoid

Be aware of these common pitfalls to ensure you have adequate coverage:

- Underestimating coverage needs:Determine your coverage requirements based on your trip duration, destination, and activities.

- Failing to read the policy carefully:Understand the terms, conditions, and exclusions of your policy before purchasing.

- Not declaring pre-existing conditions:Disclose any pre-existing medical conditions to avoid coverage denials.

- Purchasing insurance after travel begins:Coverage is typically not valid if purchased after your trip has commenced.

- Assuming your credit card provides adequate coverage:While some credit cards offer travel insurance, it may not be comprehensive enough for your needs.

Final Conclusion

As we conclude our exploration of Insider Secrets: How to Maximize Your Travel Insurance Coverage for Peace of Mind, remember that knowledge is the key to unlocking the full potential of your travel insurance. Embrace these insider tips, maximize your coverage, and embark on your adventures with the confidence that comes from knowing you’re protected.

Travel with peace of mind, knowing that your journey is covered.