Homeowners insurance quotes rhode island – When it comes to protecting your home in Rhode Island, homeowners insurance is a crucial consideration. With its unique market characteristics, comparing homeowners insurance quotes is essential to ensure you get the best coverage at the right price. This guide will provide you with all the information you need to navigate the Rhode Island homeowners insurance market and make an informed decision.

Rhode Island’s coastal location and exposure to storms make homeowners insurance a necessity. Understanding the factors that influence quotes, such as location, property age, and claims history, will help you tailor your coverage to your specific needs. By following the step-by-step guide provided, you can easily obtain quotes from multiple insurance providers.

Introduction

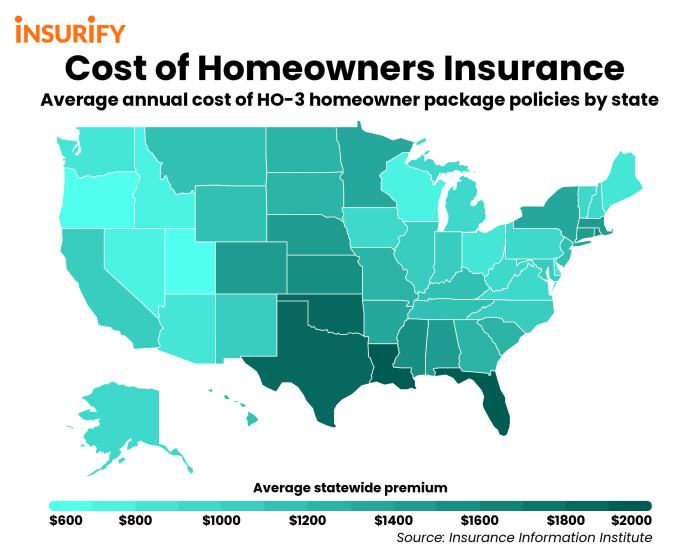

Homeowners insurance is an essential form of protection for your home and belongings in Rhode Island. It provides financial coverage in the event of damage or loss caused by covered perils such as fire, theft, vandalism, and natural disasters. Rhode Island has a unique homeowners insurance market characterized by relatively high insurance rates compared to other states. This is due to several factors, including the state’s coastal location, which exposes it to hurricanes and other storms.

Benefits of Comparing Homeowners Insurance Quotes

Given the high cost of homeowners insurance in Rhode Island, it is important to compare quotes from multiple insurance companies to find the best coverage at the most affordable price. Comparing quotes allows you to assess the coverage options and premiums offered by different insurers and make an informed decision that meets your specific needs and budget.

Factors Influencing Homeowners Insurance Quotes in Rhode Island

The cost of homeowners insurance in Rhode Island can vary significantly depending on several factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Location

The location of your home is a primary factor that influences insurance quotes. Homes in areas with higher crime rates or a history of natural disasters, such as hurricanes or floods, typically have higher premiums. Additionally, homes located in proximity to fire hydrants or fire stations may receive discounts on their insurance.

Property Age

The age of your home can also impact your insurance rates. Older homes may require more frequent repairs and maintenance, which can increase the risk of claims. As a result, insurance companies may charge higher premiums for older homes.

Claims History

Your claims history is another important factor that insurance companies consider when determining your premiums. If you have filed multiple claims in the past, it may indicate a higher risk of future claims, leading to higher insurance costs.

How to Get Homeowners Insurance Quotes in Rhode Island: Homeowners Insurance Quotes Rhode Island

Getting homeowners insurance quotes in Rhode Island is a straightforward process that can be completed in a few simple steps. Whether you prefer the convenience of online quotes, the personalized service of an agent, or the direct approach of contacting insurance companies, there are several options available to you. By providing accurate information and understanding the factors that influence your quotes, you can make an informed decision about the best coverage for your home.

Online Quotes, Homeowners insurance quotes rhode island

Online quote platforms offer a quick and easy way to compare quotes from multiple insurance companies. Simply enter your address and other relevant details, and the platform will generate a list of quotes for you to review. This method is convenient and efficient, but it’s important to note that you may not have the opportunity to discuss your specific needs with an agent.

Through Agents

Insurance agents can provide personalized advice and help you navigate the complexities of homeowners insurance. They can explain different coverage options, answer your questions, and advocate for your best interests. While this method typically involves more time and effort, it can be beneficial if you have complex insurance needs or prefer a more hands-on approach.

Directly from Insurance Companies

Contacting insurance companies directly allows you to speak with a representative and get a quote tailored to your specific situation. This method gives you the opportunity to ask questions and ensure that you fully understand your coverage options. However, it may be more time-consuming than other methods, and you may not have access to as many quotes as you would through an online platform or agent.

Regardless of the method you choose, it’s crucial to provide accurate information when requesting quotes. This includes details about your home, its construction, your claims history, and any other factors that may influence your coverage and premium.

Comparing Homeowners Insurance Quotes in Rhode Island

Comparing homeowners insurance quotes is essential to find the best coverage at an affordable price. Here are some tips for effectively comparing quotes:

Carefully review the coverage options and make sure they align with your specific needs. Consider factors such as the value of your home, your belongings, and any additional structures on your property.

Key Features to Consider

- Coverage: Determine the level of coverage you need, including dwelling coverage, personal property coverage, and liability coverage.

- Deductibles: Choose a deductible that you can afford to pay in the event of a claim. A higher deductible typically results in lower premiums.

- Premiums: Compare the total annual cost of each policy, including premiums and any additional fees or discounts.

Importance of Understanding Policy Terms

Thoroughly read and understand the terms and conditions of each policy. Pay attention to exclusions, limitations, and any special provisions that may impact your coverage.

Homeowners insurance quotes in Rhode Island can vary widely depending on factors such as the location of your home, the age of your home, and the amount of coverage you need. If you’re looking for a way to save money on your homeowners insurance, it’s worth comparing quotes from multiple insurance companies.

You may also want to consider raising your deductible, which can lower your monthly premiums. For more information on why car insurance in Massachusetts is so expensive, check out this article: why is massachusetts car insurance so expensive . If you’re a homeowner in Rhode Island, it’s important to have the right homeowners insurance coverage in place.

Contact an insurance agent today to get a quote.

Choosing the Right Homeowners Insurance Policy in Rhode Island

Selecting the appropriate homeowners insurance policy is crucial to ensure adequate protection for your home and belongings. Rhode Island offers various types of homeowners insurance policies, each with unique coverage options and costs. Understanding the distinctions between these policies empowers you to make an informed decision that aligns with your specific needs and budget.

To protect your home and belongings in Rhode Island, obtaining accurate homeowners insurance quotes is crucial. Beyond safeguarding your physical assets, consider protecting your cherished collectibles. Insurance for collectibles provides peace of mind, ensuring that your valuable items are covered in case of damage or loss.

As you gather homeowners insurance quotes in Rhode Island, remember to explore options that offer comprehensive coverage for both your home and your treasured possessions.

The following table compares the different types of homeowners insurance policies available in Rhode Island:

| Policy Type | Coverage | Advantages | Disadvantages |

|---|---|---|---|

| HO-1 (Basic Form) | Covers basic perils, such as fire, lightning, windstorms, hail, theft, and vandalism. | Low premiums | Limited coverage |

| HO-2 (Broad Form) | Provides broader coverage than HO-1, including additional perils like falling objects, weight of ice or snow, and water damage from bursting pipes. | More comprehensive coverage than HO-1 | Higher premiums than HO-1 |

| HO-3 (Special Form) | The most comprehensive homeowners insurance policy, covering all perils except those specifically excluded. | Most comprehensive coverage | Highest premiums |

| HO-4 (Renters Insurance) | Designed for renters, covering personal belongings, liability, and additional living expenses in case of a covered loss. | Protects renters from financial losses | Does not cover the structure of the building |

| HO-6 (Condominium Unit-Owners Insurance) | Covers the interior of a condominium unit, including personal belongings and liability. | Tailored for condominium owners | Does not cover the structure of the building |

Additional Considerations for Homeowners Insurance in Rhode Island

When purchasing homeowners insurance in Rhode Island, it is essential to consider additional factors beyond the basic coverage. These include flood insurance, windstorm coverage, government assistance programs, and strategies for reducing premiums.

Flood Insurance: Rhode Island is prone to flooding, making flood insurance a crucial consideration. The National Flood Insurance Program (NFIP) provides flood insurance to homeowners in high-risk areas. It is highly recommended to purchase flood insurance, even if your property is not located in a designated flood zone.

Windstorm Coverage

Rhode Island is also vulnerable to windstorms, including hurricanes and tropical storms. Windstorm coverage is typically included in homeowners insurance policies, but it is essential to ensure adequate coverage limits. Consider increasing your windstorm deductible to lower your premiums.

Homeowners insurance quotes Rhode Island provide comprehensive coverage for your home and belongings. However, if you have valuable antiques or collectibles, you may want to consider additional coverage from an antiques and collectibles insurance group . These groups specialize in insuring rare and valuable items, providing peace of mind and ensuring that your prized possessions are adequately protected.

When it comes to homeowners insurance quotes Rhode Island, it’s important to assess your needs and ensure that your policy covers all your valuable belongings.

Government Assistance Programs

The Rhode Island Department of Housing provides assistance programs to help homeowners with insurance costs. These programs include the Homeowner Assistance Fund (HAF) and the Rhode Island Housing Assistance Corporation (RIHAC). These programs can provide financial assistance to eligible homeowners who are struggling to pay their insurance premiums.

Reducing Homeowners Insurance Premiums

There are several ways to reduce your homeowners insurance premiums, including:

- Increasing your deductible: A higher deductible will lower your premiums, but it is essential to choose a deductible that you can afford to pay.

- Installing security features: Installing security devices such as alarms, deadbolts, and motion sensor lights can reduce your premiums.

- Bundling your policies: Bundling your homeowners insurance with other insurance policies, such as auto insurance, can result in discounts.

- Maintaining your property: Keeping your home in good condition can reduce the risk of damage and lower your premiums.

- Shopping around: Comparing quotes from multiple insurance companies can help you find the best coverage at the most affordable price.

Final Thoughts

Choosing the right homeowners insurance policy is paramount for safeguarding your home and financial well-being. By comparing quotes effectively, considering additional factors like flood and windstorm coverage, and exploring government assistance programs, you can secure the best protection for your Rhode Island property. Remember, investing time in researching and comparing homeowners insurance quotes can lead to significant savings and peace of mind.

FAQ Section

What factors influence homeowners insurance quotes in Rhode Island?

Factors such as location, property age, claims history, building materials, and coverage limits impact the cost of homeowners insurance in Rhode Island.

How can I get homeowners insurance quotes in Rhode Island?

You can obtain quotes online, through insurance agents, or directly from insurance companies. Provide accurate information to ensure you receive tailored quotes.

What should I consider when comparing homeowners insurance quotes?

Compare coverage amounts, deductibles, premiums, and the terms and conditions of each policy to find the best fit for your needs and budget.