In the digital age, a phone number is more than just a way to reach someone. It’s a vital asset for businesses and individuals alike. Triple A phone number insurance provides peace of mind, protecting you from the financial risks associated with losing your phone number.

This insurance covers a wide range of scenarios, from accidental deletion to fraud, ensuring that your business can continue to operate smoothly and your personal contacts remain secure.

Definition of Triple A Phone Number Insurance

Triple A phone number insurance is a type of insurance that protects businesses and individuals from the financial consequences of losing access to their phone number.

There are several different types of coverage available under triple A phone number insurance, including:

- Coverage for lost or stolen phones

- Coverage for damaged phones

- Coverage for phone number hijacking

Triple A phone number insurance can be beneficial for businesses and individuals who rely on their phone number for business or personal use. For example, a business that loses access to its phone number could lose customers and revenue. An individual who loses access to their phone number could lose access to their contacts, messages, and other important data.

Benefits of Triple A Phone Number Insurance

Triple A phone number insurance provides numerous advantages for businesses and individuals. It safeguards against the risks associated with phone number ownership, ensuring uninterrupted communication and protecting valuable assets.

With triple A phone number insurance, businesses can protect their reputation and customer base. A lost or compromised phone number can lead to missed calls, frustrated customers, and potential financial losses. Insurance ensures that businesses can maintain their phone number even in the event of unforeseen circumstances.

Triple A phone number insurance offers a convenient way to protect your valuable device. If you’re looking for a comprehensive boat insurance quote, consider exploring boat insurance quote usaa for tailored coverage options. And for added peace of mind, complement your protection with Triple A phone number insurance, ensuring your essential communication lifeline remains safe and secure.

Case Studies

In 2021, a small business owner lost access to their phone number due to a SIM card malfunction. Without insurance, they were forced to use a new number, resulting in significant customer confusion and lost revenue.

In contrast, a large corporation experienced a cyberattack that targeted their phone number. Triple A phone number insurance covered the costs of restoring the number and mitigating the damage caused by the attack.

Factors to Consider When Choosing Triple A Phone Number Insurance

Selecting the right triple A phone number insurance policy is crucial to protect your valuable phone number. Here are some key factors to consider when making your decision:

Coverage and Exclusions

Review the policy coverage to ensure it includes the specific risks you want to protect against, such as loss, theft, or accidental damage. Additionally, check for any exclusions that may limit coverage in certain situations.

Triple A phone number insurance safeguards your valuable digits against theft or loss. But don’t forget about your cherished collectibles! Protect your precious stamps, rare coins, and other treasured items with collectables insurance services . While you’re safeguarding your irreplaceable possessions, don’t overlook the importance of securing your Triple A phone number – a vital lifeline in today’s digital world.

Policy Limits and Deductibles

The policy limits determine the maximum amount the insurer will pay in the event of a covered claim. Deductibles represent the amount you will be responsible for before insurance coverage kicks in. Consider your financial situation and choose a policy with limits and deductibles that balance your needs and budget.

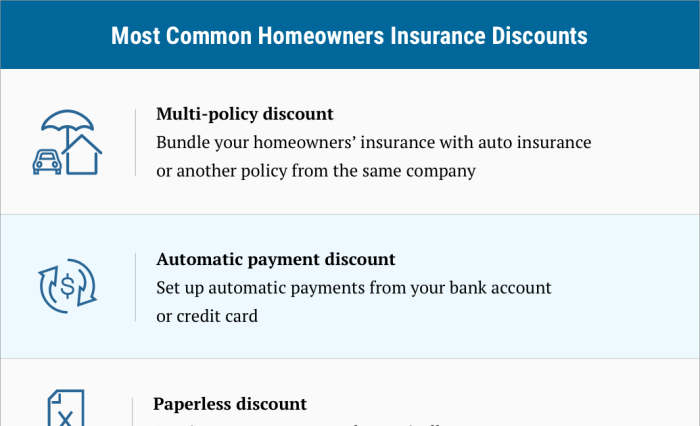

Premiums and Discounts

Compare premiums from different providers to find the best deal. Ask about any discounts that may be available, such as bundling with other insurance policies or signing up for a multi-year contract.

Customer Service and Reputation, Triple a phone number insurance

Consider the insurer’s customer service reputation. Read reviews and check online forums to see what other policyholders have experienced. Good customer service can make a significant difference when you need to file a claim.

Compare Policies and Providers

Don’t settle for the first policy you come across. Take the time to compare multiple policies from different providers to find the one that offers the best coverage, limits, premiums, and customer service for your needs.

Tips for Finding the Best Coverage

- Start by determining the specific risks you want to protect against.

- Get quotes from multiple insurers and compare their coverage, limits, and premiums.

- Read the policy documents carefully before making a decision.

- Ask your insurance agent or broker for guidance and recommendations.

- Consider your budget and choose a policy that provides adequate coverage without breaking the bank.

Limitations and Exclusions of Triple A Phone Number Insurance

Triple A phone number insurance policies typically have certain limitations and exclusions that restrict coverage in specific situations. Understanding these limitations is crucial to avoid unexpected claim denials.

Exclusions from Coverage

Triple A phone number insurance policies may exclude coverage for the following situations:

– Acts of God: Losses or damages caused by natural disasters such as hurricanes, earthquakes, or floods.

– Theft or Loss: The theft or loss of the phone number itself is usually not covered.

– Unauthorized Use: Unauthorized use of the phone number by a third party without the policyholder’s consent.

– Illegal Activities: Damages resulting from illegal activities or violations of the law.

– Intentional Damage: Losses or damages caused intentionally by the policyholder or their employees.

Cost of Triple A Phone Number Insurance

The cost of triple A phone number insurance is influenced by several factors, including:

- The level of coverage desired

- The value of the phone number

- The deductible amount

- The insurance company’s underwriting criteria

Premiums for triple A phone number insurance can range from a few hundred dollars to several thousand dollars per year. The higher the level of coverage, the higher the premium. The value of the phone number is also a factor, as higher-value phone numbers will require more coverage. The deductible amount is the amount that the insured will be responsible for paying out of pocket before the insurance coverage kicks in. A higher deductible will result in a lower premium. Finally, the insurance company’s underwriting criteria will also affect the cost of insurance. Some insurance companies may have stricter underwriting criteria than others, which can result in higher premiums.

Here are some tips on how to reduce the cost of triple A phone number insurance:

- Choose a lower level of coverage.

- Increase the deductible amount.

- Shop around for the best rates.

How to File a Claim Under Triple A Phone Number Insurance

Filing a claim under Triple A Phone Number Insurance involves a straightforward process. To ensure a successful claim, it is crucial to follow the necessary steps and provide the required documentation.

Steps Involved in Filing a Claim:

Triple A phone number insurance can provide peace of mind in case your phone is lost or stolen. If you’re looking for a reliable insurance provider in Buffalo, NY, consider aaa insurance buffalo ny . They offer comprehensive coverage and excellent customer service.

Plus, with their convenient online portal, you can easily manage your policy and file claims anytime, anywhere. Triple A phone number insurance is an essential investment for anyone who relies on their phone for work or personal use.

- Report the Incident: Immediately report the incident to Triple A and provide details of the loss or damage.

- Gather Evidence: Collect documentation to support your claim, such as police reports, repair estimates, or witness statements.

- Submit the Claim: File the claim form online or through an agent, providing all relevant information and supporting documents.

- Review and Assessment: Triple A will review the claim and assess the damage to determine coverage and compensation.

- Settlement: Once the claim is approved, Triple A will issue payment for the covered damages.

Maximizing Chances of a Successful Claim:

- Provide clear and detailed information about the incident.

- Gather as much supporting documentation as possible.

- Submit the claim promptly to avoid any potential delays.

- Cooperate fully with Triple A’s investigation process.

- Review the policy terms carefully to understand coverage limitations.

Conclusive Thoughts

Triple A phone number insurance is an essential investment for anyone who relies on their phone number for business or personal communication. It provides comprehensive protection against a variety of risks, ensuring that you can always stay connected and maintain your reputation.

Q&A

What types of coverage are available under Triple A phone number insurance?

Triple A phone number insurance typically covers accidental deletion, fraud, and unauthorized porting of your phone number.

How much does Triple A phone number insurance cost?

The cost of Triple A phone number insurance varies depending on the level of coverage you choose and the value of your phone number. However, premiums typically range from $10 to $50 per month.

How do I file a claim under Triple A phone number insurance?

To file a claim under Triple A phone number insurance, you will need to contact your insurance provider and provide documentation of the incident. This may include a police report, a letter from your phone company, or a screenshot of the unauthorized activity.