Navigating the world of travel insurance can be a daunting task, but it doesn’t have to be. With a little research and planning, you can find a policy that provides the coverage you need without breaking the bank. Here are 10 essential tips to help you save money on travel insurance without sacrificing coverage.

From understanding your coverage needs to utilizing credit card benefits, this comprehensive guide will equip you with the knowledge you need to make informed decisions and protect yourself financially while traveling.

Understand Your Coverage Needs

To ensure you get the right travel insurance coverage without overpaying, it’s crucial to first understand your specific travel risks and coverage requirements. This involves considering factors such as the duration of your trip, your destination, the activities you plan to engage in, and your personal circumstances.

By taking the time to assess your individual needs, you can avoid purchasing unnecessary coverage and ensure you have the essential protection in place.

Factors to Consider

-

- Trip Duration: Longer trips typically require more comprehensive coverage.

- Destination: Certain destinations may pose unique risks, such as political instability or high crime rates.

- Activities: Adventurous activities like hiking or scuba diving may require specialized coverage.

li>Personal Circumstances: Pre-existing medical conditions or age may impact your coverage needs.

Compare Different Policies

To ensure you find the best travel insurance policy for your needs and budget, it’s crucial to compare various options from different providers. By meticulously reviewing coverage details, premiums, deductibles, and exclusions, you can identify policies that align with your specific requirements and financial constraints.

Key Coverage Details

- Medical expenses: Coverage for medical emergencies, including hospitalization, doctor visits, and prescription drugs.

- Trip cancellation and interruption: Reimbursement for non-refundable expenses if your trip is canceled or interrupted due to covered reasons.

- Baggage loss or damage: Protection for lost, stolen, or damaged luggage and personal belongings.

- Emergency assistance: Access to 24/7 assistance for medical emergencies, lost documents, or other unexpected events.

Premiums and Deductibles

Premiums are the cost of the insurance policy, while deductibles are the amount you pay out-of-pocket before the insurance coverage kicks in. Consider your budget and risk tolerance when comparing premiums and deductibles.

Exclusions

Carefully review the policy exclusions to ensure you understand what is not covered. Common exclusions include pre-existing medical conditions, high-risk activities, and certain destinations.

Look for Discounts and Promotions

Take advantage of discounts and promotions offered by insurance companies to save money on travel insurance. Many companies provide discounts for multiple policies, loyalty programs, and seasonal promotions. Research available options and apply them during the purchase process to reduce your overall cost.

Group Discounts

If you’re traveling with a group, inquire about group discounts. Some insurance companies offer reduced rates for groups of three or more travelers.

Loyalty Programs

Join loyalty programs offered by insurance companies. These programs often provide discounts and rewards for repeat customers. By accumulating points or meeting certain criteria, you can unlock exclusive savings on future travel insurance purchases.

Seasonal Promotions

Keep an eye out for seasonal promotions and limited-time offers. Insurance companies may run special promotions during specific times of the year, such as during peak travel season or off-season periods.

Consider Travel Insurance Aggregators

Travel insurance aggregators are online platforms that allow you to compare quotes from multiple travel insurance providers in one place. They act as a marketplace for travel insurance, making it easier for you to find the best policy for your needs at a competitive price.

To use a travel insurance aggregator, simply enter your travel details (such as your destination, travel dates, and age) and the aggregator will search its database of providers to find policies that match your criteria. You can then compare the policies side-by-side, based on factors such as coverage, cost, and customer reviews.

Benefits of Using Travel Insurance Aggregators

- Convenience:Aggregators save you time and effort by allowing you to compare multiple policies in one place.

- Competitive Rates:Aggregators often have access to exclusive discounts and promotions from providers, which can help you save money on your travel insurance.

- Impartial Advice:Aggregators are not affiliated with any particular provider, so they can provide unbiased advice on which policy is best for you.

Negotiate with Your Insurer

Engaging in negotiations with your insurance provider presents an opportunity to potentially secure lower premiums on your travel insurance policy. By presenting a compelling case supported by factors such as your travel history, loyalty, or other relevant considerations, you can increase your chances of obtaining a more favorable rate.

Build a Strong Case

- Travel history:Highlight your extensive travel experience and the absence of any previous claims. A proven track record of responsible travel demonstrates your understanding of travel risks and responsible behavior.

- Loyalty:If you have consistently purchased travel insurance from the same provider, emphasize your loyalty and inquire about any loyalty discounts or rewards programs that may be available.

- Group discounts:If you are traveling with a group, explore the possibility of negotiating a group discount. This can be especially beneficial for larger groups or families.

- Additional factors:Consider any other factors that may strengthen your case, such as your age, health, or occupation. If you have a stable income or a low-risk lifestyle, you may be eligible for lower premiums.

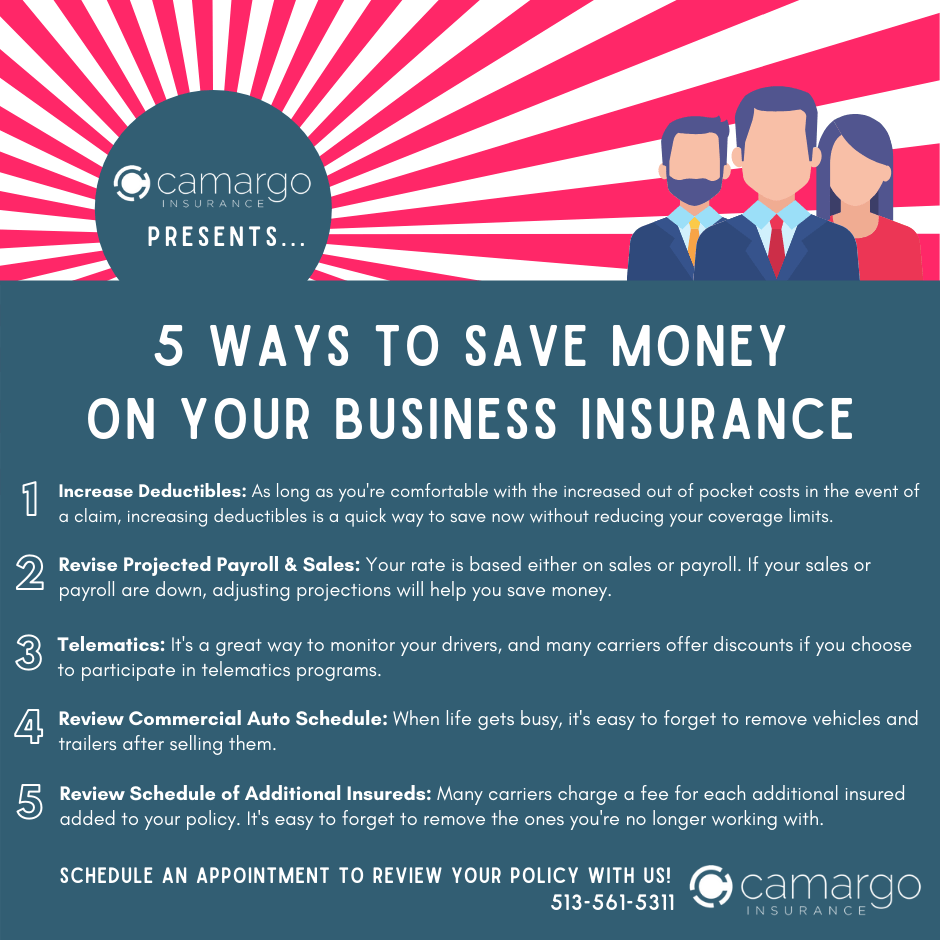

Increase Your Deductible

Increasing your deductible is a straightforward way to reduce your premium costs. A deductible is the amount you have to pay out-of-pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially taking on more financial responsibility in the event of a claim.

This reduces the risk for the insurance company, allowing them to offer lower premiums.

However, it’s important to strike a balance between your deductible and coverage limits. A higher deductible means lower premiums, but it also means you’ll have to pay more out-of-pocket if you need to file a claim. Consider your financial situation and risk tolerance when determining the appropriate deductible for your travel insurance policy.

Benefits of Increasing Your Deductible

- Lower premium costs

- Potential for significant savings over the life of the policy

Considerations Before Increasing Your Deductible

- Your financial situation and ability to pay the deductible in the event of a claim

- The likelihood of needing to file a claim

- The coverage limits of the policy and how they align with your risk tolerance

Utilize Credit Card Benefits

Using credit cards that provide travel insurance coverage can be a convenient and cost-effective way to protect yourself while traveling. Many premium credit cards offer comprehensive travel insurance benefits, including coverage for trip cancellation, trip interruption, lost luggage, and medical emergencies.

Eligibility Criteria and Coverage Details

To be eligible for credit card travel insurance, you typically need to use the card to purchase your travel expenses, such as flights, accommodation, or tours. The coverage details and limits vary depending on the specific credit card and issuer.

It’s important to carefully review the terms and conditions of your credit card agreement to understand the coverage you’re entitled to.

Limitations

While credit card travel insurance can provide valuable protection, it’s important to be aware of its limitations. Some common exclusions include:

- Pre-existing medical conditions

- High-risk activities (e.g., skydiving, bungee jumping)

- Travel to certain countries or regions

It’s always advisable to read the policy carefully and consider purchasing additional travel insurance if necessary to ensure you have adequate coverage for your specific needs.

Travel During Off-Peak Seasons

Venturing beyond the confines of peak tourist seasons can unlock substantial savings on travel insurance premiums. During off-peak or shoulder seasons, when travel demand wanes, insurance providers recognize the reduced risk associated with fewer travelers. This favorable market condition translates into lower insurance costs for savvy travelers seeking to stretch their budgets.

For instance, consider a family planning a weeklong beach vacation during the bustling summer months. Their travel insurance policy may command a hefty premium due to the high volume of travelers and potential risks. However, by shifting their travel dates to the less crowded spring or fall, they could secure a policy with significantly lower premiums, potentially saving hundreds of dollars.

Consider Alternative Coverage Options

When seeking financial protection while traveling, traditional travel insurance isn’t the only option. Consider alternative coverage options that may align better with your specific needs and budget.

- *Travel Medical Insurance

- Offers coverage for medical expenses incurred during your trip, including doctor visits, hospital stays, and emergency transportation.

- Typically excludes non-medical expenses like lost luggage or trip delays.

- May be more affordable than comprehensive travel insurance, especially for short-term trips or those with limited coverage needs.

Local Health Coverage

- Provides coverage for medical expenses in the country you’re visiting, similar to travel medical insurance.

- May be more cost-effective if you’re staying in one destination for an extended period.

- May not cover non-medical expenses or emergency evacuation.

Benefits and Limitations

|

- *Coverage Type |

- *Benefits |

- *Limitations |

|—|—|—|| Traditional Travel Insurance | Comprehensive coverage for a wide range of travel-related risks | Higher premiums || Travel Medical Insurance | Focused coverage for medical expenses | Excludes non-medical expenses || Local Health Coverage | Affordable option for extended stays | Limited coverage compared to travel insurance |

Closing Notes

By following these tips, you can save money on travel insurance without sacrificing coverage. Remember to compare policies, look for discounts, and consider alternative coverage options to find the best deal for your needs. With a little effort, you can ensure that you have the protection you need without overpaying.

So, pack your bags, embrace the spirit of adventure, and travel with confidence knowing that you’re financially protected.