AAA NJ auto insurance offers a wide range of coverage options, discounts, and exceptional customer service. Let’s dive into the details to help you make an informed decision about your auto insurance needs in New Jersey.

AAA’s comprehensive coverage plans, competitive rates, and commitment to customer satisfaction make them a top choice for drivers in the state. From multi-car discounts to safe driver programs, AAA NJ provides various ways to save on your auto insurance premiums.

Coverage and Rates

Auto insurance in New Jersey provides financial protection for drivers and their vehicles in the event of an accident. Various types of coverage are available, including:

Liability Coverage

Liability coverage protects you if you cause an accident and are legally responsible for the injuries or damages to others. New Jersey requires drivers to carry a minimum of $15,000 in bodily injury liability per person, $30,000 per accident, and $5,000 in property damage liability.

Collision Coverage

Collision coverage pays for damages to your vehicle if you are involved in an accident with another vehicle or object. It is not required by law but is highly recommended.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision-related damages, such as theft, vandalism, or natural disasters. It is also not required by law but is recommended if you have a newer or expensive vehicle.

Factors Affecting Rates

Several factors influence auto insurance rates in New Jersey, including:

- Age: Younger drivers typically pay higher rates due to their increased risk of accidents.

- Driving history: Drivers with a history of accidents or traffic violations will pay higher rates.

- Location: Rates vary depending on the location of the vehicle, with urban areas generally having higher rates than rural areas.

- Vehicle type: Sports cars and luxury vehicles typically have higher rates than standard sedans.

- Insurance company: Different insurance companies use different rating factors, resulting in varying rates.

Comparing Rates

It is essential to compare rates from multiple insurance companies before purchasing auto insurance in New Jersey. Online comparison tools can help you quickly compare quotes from different providers. By comparing rates, you can ensure you get the best coverage at the most affordable price.

When it comes to protecting your vehicle, AAA NJ Auto Insurance offers a wide range of coverage options. However, if you’re planning an upcoming trip, consider supplementing your auto insurance with a comprehensive travel insurance policy from Seven Corners Travel Insurance.bbb

. Their plans provide peace of mind while you’re away, covering unexpected events such as medical emergencies, lost luggage, and trip cancellations. Rest assured that with both AAA NJ Auto Insurance and Seven Corners Travel Insurance.bbb, you’ll have the protection you need to enjoy your journey with confidence.

Discounts and Savings: Aaa Nj Auto Insurance

New Jersey drivers can take advantage of various discounts and savings to reduce their auto insurance premiums. These include multi-car discounts, good driver discounts, and safe driver programs.

When you’re looking for the best auto insurance coverage, it’s important to compare quotes from multiple providers. AAA NJ auto insurance is a great option, but you may also want to consider getting a quote from USAA. Get a USAA auto insurance quote today and see how much you could save.

AAA NJ auto insurance is known for its excellent customer service and wide range of coverage options, so you can be sure you’re getting the best possible coverage for your needs.

To qualify for multi-car discounts, you must insure multiple vehicles under the same policy. Good driver discounts are available to drivers with a clean driving record, while safe driver programs offer discounts for completing defensive driving courses or installing safety features in your vehicle.

Tips for Saving Money on Auto Insurance in New Jersey

- Shop around for the best rates.

- Maintain a good driving record.

- Take advantage of discounts and savings.

- Increase your deductible.

- Consider usage-based insurance.

Claims Process

In the unfortunate event of an accident, filing a claim with your auto insurance provider in New Jersey is a crucial step towards receiving compensation for damages and losses. The claims process involves several important steps, and understanding them can help you navigate the process smoothly and efficiently.

AAA NJ auto insurance offers comprehensive protection for your vehicles. If you have valuable collections that need safeguarding, consider exploring collectibles insurance companies that specialize in protecting these cherished items. Their tailored policies can provide peace of mind, ensuring your collectibles are covered against loss or damage.

Remember, AAA NJ auto insurance remains a trusted choice for your automotive needs, providing reliable protection on the road.

Here’s a step-by-step guide on how to file an auto insurance claim in New Jersey:

Reporting the Accident

- Contact the police immediately to report the accident and obtain an official police report. This report will serve as a valuable record of the incident.

- Exchange information with the other driver(s) involved, including names, contact information, insurance company, and policy numbers.

- Take photos of the accident scene, including damage to vehicles, injuries, and any other relevant details.

- Notify your insurance company about the accident as soon as possible. Most companies have a 24/7 claims hotline that you can call to report the incident.

Filing the Claim

- Provide your insurance company with all the information you have gathered, including the police report, photos, and contact details of the other driver(s).

- Your insurance company will assign a claims adjuster to your case. The adjuster will investigate the accident, assess the damages, and determine the amount of compensation you are entitled to.

- You may be required to provide additional documentation, such as medical records or repair estimates, to support your claim.

- Once the investigation is complete, your insurance company will issue a settlement offer. You have the right to negotiate the settlement amount if you believe it is not fair.

Types of Claims Covered, Aaa nj auto insurance

Auto insurance in New Jersey typically covers the following types of claims:

- Collision coverage: Damages to your vehicle caused by a collision with another vehicle or object.

- Comprehensive coverage: Damages to your vehicle caused by events other than a collision, such as theft, vandalism, or natural disasters.

- Liability coverage: Damages to other people or property caused by your negligence while driving.

- Personal injury protection (PIP): Medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/underinsured motorist coverage: Damages caused by a driver who is uninsured or underinsured.

Customer Service

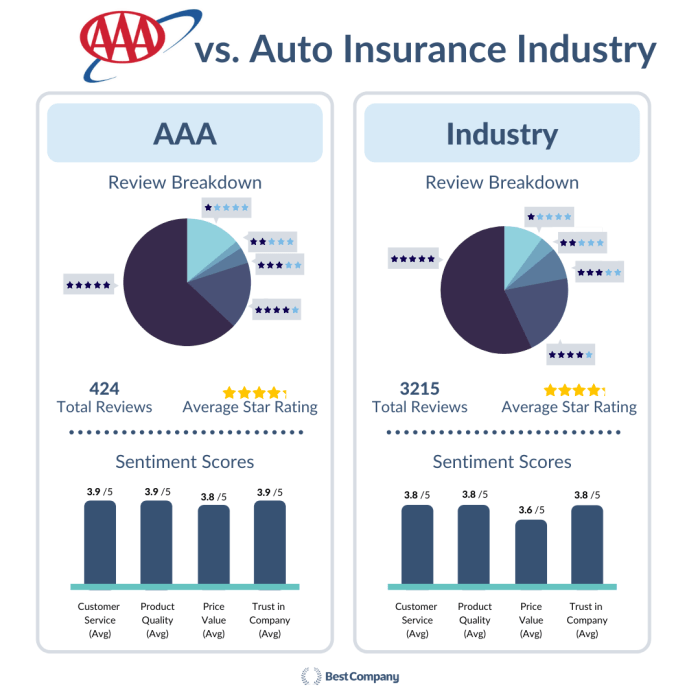

Customer service is an important factor to consider when choosing an auto insurance company in New Jersey. A good insurance company will have a team of knowledgeable and helpful customer service representatives who can answer your questions and help you with your claims.

Tips for Finding an Auto Insurance Company with Good Customer Service

Here are some tips for finding an auto insurance company with good customer service:

- Read online reviews. There are many websites where you can read reviews of auto insurance companies. This can give you a good idea of what other customers have experienced with the company’s customer service.

- Talk to your friends and family. Ask your friends and family if they have any recommendations for auto insurance companies with good customer service.

- Contact the company directly. You can call or email the auto insurance company to ask about their customer service. You can also visit their website to see if they have any information about their customer service department.

Final Review

Whether you’re a new driver or an experienced motorist, AAA NJ auto insurance has a solution tailored to your specific needs. Their user-friendly claims process, coupled with their excellent customer support, ensures a seamless and stress-free experience. By choosing AAA NJ, you can drive with confidence, knowing that you’re protected by a reputable and reliable insurance provider.

FAQ Section

What types of auto insurance coverage does AAA NJ offer?

AAA NJ offers a comprehensive range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

How can I qualify for discounts on my AAA NJ auto insurance?

AAA NJ offers various discounts, such as multi-car discounts, good driver discounts, and safe driver programs. To qualify, you may need to maintain a clean driving record, complete a defensive driving course, or insure multiple vehicles with AAA.

What is the claims process like with AAA NJ auto insurance?

AAA NJ’s claims process is designed to be user-friendly and efficient. You can file a claim online, over the phone, or through their mobile app. Their claims adjusters will guide you through the process and ensure a prompt and fair settlement.