In the ever-evolving landscape of modern business, the interconnectedness of insurance and ecosystems has emerged as a pivotal force, shaping the way businesses manage risk, optimize operations, and drive innovation. Connected insurance ecosystems are revolutionizing the industry, offering a plethora of benefits that are essential for businesses to thrive in today’s competitive environment.

This comprehensive guide delves into the intricate world of connected insurance ecosystems, exploring their key components, benefits, challenges, and future prospects. Through real-world examples and expert insights, we will uncover the transformative power of these ecosystems and their profound impact on the insurance industry.

Introduction to Connected Insurance Ecosystems

Connected insurance ecosystems are digital platforms that connect insurance companies, policyholders, and other stakeholders to improve the insurance experience. They allow insurers to offer personalized products and services, streamline claims processing, and reduce costs.Benefits of connected insurance ecosystems for businesses include:

- Improved customer experience

- Increased efficiency

- Reduced costs

Examples of successful connected insurance ecosystems include:

- InsurTech startups like Lemonade and Root

- Traditional insurance companies like State Farm and Allstate

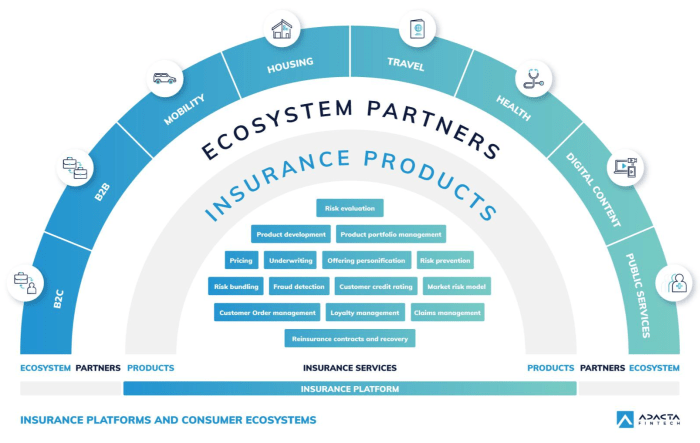

Key Components of Connected Insurance Ecosystems

Connected insurance ecosystems are built on a foundation of key components that work together to facilitate data sharing, enable advanced analytics, and automate processes. These components include:

The interplay of these components creates a robust and interconnected system that enhances the efficiency, accuracy, and personalization of insurance services.

Data Sharing Platforms

Data sharing platforms provide a secure and centralized repository for collecting and exchanging data from various sources within the ecosystem. This data can include policyholder information, claims history, telematics data, and external data sources such as weather patterns or traffic conditions.

Telematics Devices

Telematics devices are installed in vehicles and collect real-time data on driving behavior, vehicle performance, and environmental conditions. This data can be used to assess risk, personalize insurance premiums, and provide usage-based insurance products.

Artificial Intelligence (AI)

AI algorithms are used to analyze the vast amounts of data collected from various sources. AI can identify patterns, predict risks, detect fraud, and automate underwriting and claims processing tasks.

Analytics Tools

Analytics tools provide insurers with insights into the data collected from the ecosystem. These tools can be used to identify trends, segment customers, and develop targeted marketing campaigns.

Benefits of Connected Insurance Ecosystems for Modern Businesses

Connected insurance ecosystems offer a plethora of benefits to modern businesses, empowering them to navigate the evolving risk landscape and drive growth. These ecosystems facilitate:

Improved Risk Management

By connecting various data sources, businesses gain a comprehensive view of their risk exposure. This enables proactive risk identification, assessment, and mitigation, reducing the likelihood and severity of incidents.

Reduced Insurance Costs

Insurance ecosystems provide insurers with a more granular understanding of businesses’ risk profiles. This allows for tailored insurance policies that accurately reflect the level of risk, leading to potential cost savings.

Enhanced Customer Service

Ecosystems streamline customer interactions by integrating data from multiple sources. This enables insurers to provide personalized services, faster claims processing, and proactive support, enhancing customer satisfaction and loyalty.

New Product and Service Development Opportunities

Connected insurance ecosystems foster collaboration and innovation. They allow businesses to access new data sources and insights, which can inform the development of novel insurance products and services that meet evolving market needs.

Challenges and Considerations for Implementing Connected Insurance Ecosystems

Implementing connected insurance ecosystems offers numerous advantages, but it also presents challenges that businesses must address. Understanding these challenges and considering appropriate strategies to overcome them is crucial for successful implementation.

Data Privacy and Security Concerns

Data privacy and security are paramount concerns in connected insurance ecosystems, as they involve the exchange and storage of sensitive customer information. Businesses must implement robust data protection measures to safeguard this data from unauthorized access, breaches, or misuse. This includes adhering to industry regulations, employing encryption technologies, and establishing clear data governance policies.

Integration with Existing Systems

Integrating connected insurance ecosystems with existing business systems can be complex and time-consuming. Businesses must carefully plan and execute the integration process to ensure seamless data flow and avoid disruptions to operations. This may involve customizing existing systems, developing new interfaces, or partnering with third-party providers to facilitate integration.

Cost of Implementation

Implementing connected insurance ecosystems can involve significant upfront costs, including technology investments, data integration expenses, and ongoing maintenance. Businesses must carefully assess the return on investment (ROI) and ensure that the benefits outweigh the costs before committing to implementation.

The Future of Connected Insurance Ecosystems

The future of connected insurance ecosystems is bright. As technology continues to evolve, we can expect to see even more innovation in this space. Blockchain technology, AI, and machine learning will all play a major role in shaping the future of connected insurance ecosystems.

Blockchain technology can be used to create a secure and transparent ledger of insurance transactions. This will help to reduce fraud and improve the efficiency of the insurance claims process. AI and machine learning can be used to automate many of the tasks that are currently performed manually by insurance companies.

This will free up insurance companies to focus on more strategic initiatives.

The Use of Blockchain Technology

Blockchain technology is a distributed database that is used to maintain a continuously growing list of records, called blocks. Each block contains a timestamp, a transaction record, and a reference to the previous block. Once a block is added to the chain, it cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.

Blockchain technology has the potential to revolutionize the insurance industry by providing a secure and transparent way to track and manage insurance data. This could lead to reduced fraud, lower costs, and improved customer service.

The Integration of AI and Machine Learning

AI and machine learning are two rapidly growing fields that have the potential to transform many industries, including insurance. AI can be used to automate tasks, make predictions, and identify patterns. Machine learning can be used to train AI models on large datasets.

The integration of AI and machine learning into connected insurance ecosystems could lead to a number of benefits, including:

- Automated underwriting

- Personalized insurance products

- Improved fraud detection

- Faster claims processing

The Development of New Insurance Products and Services

The development of new insurance products and services is another key trend that we can expect to see in the future of connected insurance ecosystems. These new products and services will be designed to meet the changing needs of consumers and businesses.

For example, we may see the development of new insurance products that cover emerging risks, such as cyberattacks and data breaches. We may also see the development of new insurance services that provide personalized advice and support to consumers and businesses.

The Potential Impact of These Trends on the Insurance Industry

The trends that we have discussed in this section have the potential to have a major impact on the insurance industry. These trends could lead to reduced costs, improved efficiency, and new insurance products and services. They could also lead to a more personalized and customer-centric insurance experience.

Insurance companies that are able to successfully adapt to these trends will be well-positioned to succeed in the future. Those that fail to adapt may find themselves struggling to compete.

Final Wrap-Up

As the insurance industry continues to evolve, connected insurance ecosystems will undoubtedly play an increasingly prominent role. By embracing these ecosystems, businesses can unlock a wealth of opportunities, from enhanced risk management to innovative product development. The future of insurance lies in connectivity, and those who embrace this transformation will be well-positioned to succeed in the years to come.