In the realm of insurance, driving claims insights have emerged as a beacon of knowledge, guiding carriers towards a future of informed decision-making. This data-rich landscape holds the power to transform claims handling, risk assessment, and product development, paving the way for insurers to navigate the complexities of the industry with precision and agility.

As we delve into the intricacies of driving claims analysis, we will uncover the art of extracting meaningful patterns and trends from vast datasets. Predictive models, fueled by these insights, will empower carriers to identify high-risk drivers, optimize claims processes, and tailor insurance products to specific driver profiles.

Join us on this data-driven journey as we explore the transformative potential of driving claims insights for insurance carriers.

Driving Claims Data Analysis

Driving claims data analysis involves examining data related to insurance claims filed for incidents involving vehicles. This data provides valuable insights into the factors contributing to accidents, the severity of claims, and patterns in driver behavior. By analyzing this data, insurance carriers can identify trends, assess risks, and develop strategies to reduce claims frequency and severity.

Data Sources for Driving Claims Analysis

Driving claims data can be obtained from various sources, including:

- Insurance company records:This includes claims history, policy information, and driver details.

- Police reports:These provide information about the circumstances of the accident, including driver behavior, road conditions, and vehicle damage.

- Telematics data:Collected from devices installed in vehicles, this data includes information on driving habits, such as speed, acceleration, and braking patterns.

- Third-party data providers:These companies collect and aggregate data from multiple sources, providing comprehensive insights into driving behavior and claims trends.

Identifying Patterns and Trends

Identifying patterns and trends in driving claims data is crucial for insurance carriers to optimize their underwriting and claims management strategies. This involves analyzing key metrics and KPIs to uncover insights that can inform decision-making and improve outcomes.

Key Metrics and KPIs for Driving Claims Analysis

Key metrics and KPIs for driving claims analysis include:

- Claim frequency: Number of claims per policy or per insured

- Claim severity: Average cost of a claim

- Loss ratio: Ratio of claims costs to earned premiums

- Combined ratio: Ratio of total claims and expenses to earned premiums

- Average claim cycle time: Time taken to process and settle a claim

Methods for Analyzing Data to Identify Patterns and Trends

Various methods can be used to analyze driving claims data to identify patterns and trends, including:

- Descriptive statistics: Summarizing data using measures such as mean, median, mode, and standard deviation

- Hypothesis testing: Using statistical tests to determine if there are significant differences between groups

- Regression analysis: Modeling the relationship between dependent and independent variables to predict outcomes

- Clustering: Grouping similar data points together to identify distinct segments

- Time series analysis: Analyzing data over time to identify trends and seasonality

Visualizations and Dashboards for Presenting Insights

Insights derived from driving claims analysis can be effectively communicated through visualizations and dashboards. These may include:

- Bar charts and line graphs: Displaying trends over time or comparing different groups

- Scatter plots: Showing the relationship between two variables

- Heat maps: Visualizing the distribution of data across different categories

- Interactive dashboards: Allowing users to explore data and insights in real-time

Risk Assessment and Modeling

Driving claims data plays a crucial role in risk assessment for insurance carriers. It provides insights into the frequency and severity of claims, helping insurers to identify and understand risk factors associated with different drivers and vehicles.

To develop predictive models for identifying high-risk drivers, insurers use statistical techniques such as logistic regression, decision trees, and neural networks. These models analyze historical claims data to identify patterns and relationships between driver characteristics (e.g., age, gender, driving history) and claim outcomes.

The models assign a risk score to each driver, indicating their likelihood of filing a claim in the future.

Validating and Evaluating Risk Models

To ensure the accuracy and reliability of risk models, insurers employ various validation and evaluation techniques:

- Data splitting:The claims data is divided into training and testing sets. The model is trained on the training set and evaluated on the testing set to assess its predictive performance.

- Cross-validation:The claims data is randomly divided into multiple subsets. The model is trained and evaluated on different combinations of these subsets to reduce the impact of data variability.

- Performance metrics:Metrics such as accuracy, precision, recall, and AUC-ROC are used to evaluate the model’s ability to correctly classify high-risk drivers.

Claims Management Optimization

Driving claims insights empower insurance carriers to optimize claims handling processes, enhancing efficiency and customer satisfaction. By leveraging data-driven insights, carriers can identify areas for improvement, streamline workflows, and reduce claims settlement times.

Optimizing claims management involves identifying opportunities to reduce costs and improve customer satisfaction. Driving claims insights can help carriers achieve these goals by providing a comprehensive view of claims data, enabling them to make informed decisions and implement effective strategies.

Reducing Claims Costs

- Early identification of high-risk claims: Driving claims insights can help carriers identify claims with a higher likelihood of becoming costly or complex, allowing them to allocate resources proactively.

- Improved fraud detection: Data analysis can uncover patterns and anomalies that indicate potential fraud, enabling carriers to take swift action to mitigate losses.

- Negotiation optimization: Insights into driving behavior and claims history can strengthen carriers’ negotiating position, leading to favorable settlements.

Improving Customer Satisfaction

- Faster claims settlement: By streamlining processes and leveraging data to expedite investigations, carriers can reduce settlement times, improving customer experience.

- Personalized claims handling: Insights into driving patterns and customer preferences allow carriers to tailor claims handling to individual needs, enhancing customer satisfaction.

- Improved communication: Data-driven insights facilitate proactive communication with policyholders, keeping them informed and reducing anxiety during the claims process.

Insurance Product Development

Driving claims insights provide valuable information for insurance carriers to develop tailored products that meet the specific needs of different driver profiles. By analyzing claims data, insurers can identify patterns, trends, and risk factors associated with various driving behaviors and vehicle types.

This information can be used to develop innovative insurance products that offer customized coverage options, pricing, and discounts based on individual driving habits and risk profiles. These products can help insurers attract and retain customers, improve profitability, and enhance the overall customer experience.

Tailoring Insurance Products

Data-driven insights enable insurers to tailor insurance products to specific driver profiles. For example, insurers can offer:

- Usage-based insurance (UBI) programs that track driving behavior and reward safe drivers with lower premiums.

- Pay-as-you-drive (PAYD) insurance that charges premiums based on the number of miles driven, allowing low-mileage drivers to save money.

- Telematics-based insurance that uses sensors and data analytics to monitor vehicle performance and driving habits, providing personalized risk assessments and tailored coverage.

Innovative Insurance Products

Driving claims analysis has led to the development of innovative insurance products that cater to the evolving needs of drivers. Some examples include:

- Ride-sharing insurance that provides coverage for drivers who use ride-sharing platforms like Uber or Lyft.

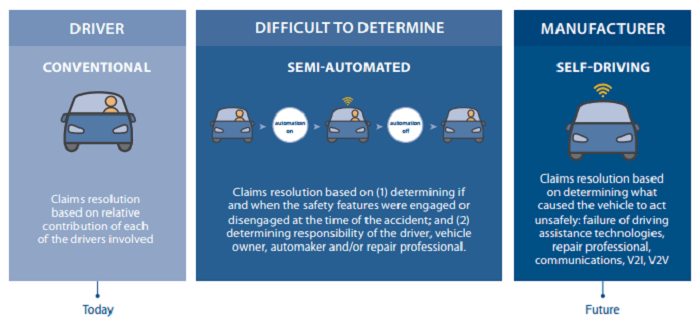

- Autonomous vehicle insurance that covers potential liabilities associated with self-driving cars.

- Personalized insurance that uses artificial intelligence (AI) and machine learning to analyze individual driving data and offer customized coverage and pricing.

Regulatory Compliance and Reporting

Driving claims data plays a crucial role in regulatory compliance for insurance carriers. It provides valuable insights that support adherence to reporting requirements and industry best practices.

Data Management Best Practices

Insurance carriers must implement robust data management practices to ensure accuracy, completeness, and accessibility of driving claims data. This includes establishing clear data collection protocols, maintaining data integrity through validation and verification processes, and implementing data security measures to protect sensitive information.

Ultimate Conclusion

In conclusion, driving claims insights have revolutionized the insurance industry, arming carriers with the knowledge they need to thrive in an ever-changing landscape. By harnessing the power of data, insurers can gain a competitive edge, improve customer satisfaction, and ultimately fulfill their mission of providing tailored protection for drivers.

As the industry continues to evolve, driving claims insights will undoubtedly remain a cornerstone of innovation and growth for insurance carriers.