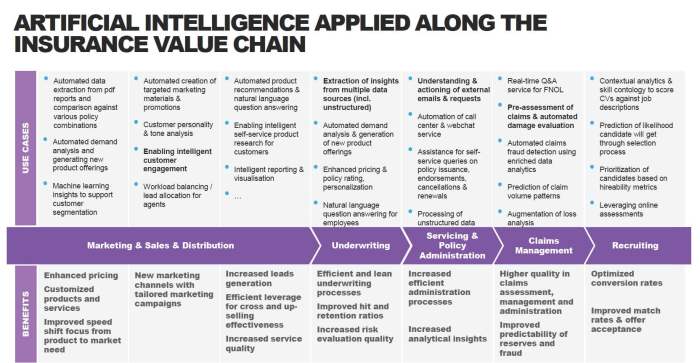

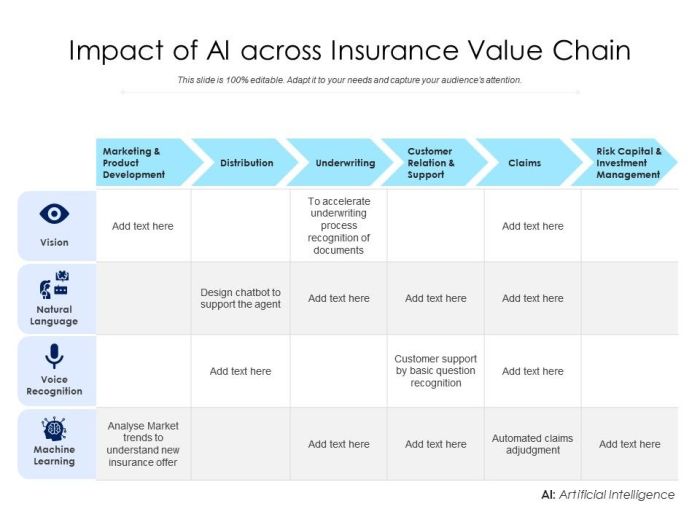

The advent of Artificial Intelligence (AI) has revolutionized the insurance industry, transforming every aspect of its operations. This comprehensive guide delves into the myriad ways AI can be leveraged throughout the insurance value chain, starting with sales and distribution, to drive efficiency, enhance customer experiences, and unlock new opportunities.

From lead generation and underwriting to claims processing and risk management, AI is reshaping the insurance landscape. By harnessing its capabilities, insurers can streamline processes, reduce costs, improve decision-making, and deliver unparalleled customer service. This guide will provide a roadmap for insurers seeking to embrace AI’s transformative potential and gain a competitive edge in the rapidly evolving insurance market.

Introduction

The insurance industry is a vital part of the global economy, providing financial protection to individuals and businesses against various risks. The insurance value chain encompasses a wide range of activities, including sales and distribution, underwriting, claims processing, and customer service.

In recent years, artificial intelligence (AI) has emerged as a transformative technology for the insurance sector. AI has the potential to automate many tasks, improve decision-making, and provide personalized experiences for customers.

Importance of AI in Insurance

- Automation:AI can automate many repetitive and time-consuming tasks, such as data entry, claims processing, and fraud detection.

- Improved decision-making:AI algorithms can analyze large amounts of data to identify patterns and make more accurate predictions. This can help insurers make better decisions about underwriting, pricing, and claims management.

- Personalized experiences:AI can be used to personalize the insurance experience for customers. For example, insurers can use AI to tailor policies to individual needs, provide personalized recommendations, and offer proactive customer service.

Sales and Distribution

AI plays a transformative role in the sales and distribution of insurance products, enhancing efficiency and improving customer experiences. From lead generation and qualification to underwriting and pricing, AI empowers insurers to make informed decisions and deliver personalized solutions.

Lead Generation and Qualification

- AI-powered lead generation tools analyze vast amounts of data to identify potential customers who meet specific criteria, such as demographics, behavior, and interests.

- Machine learning algorithms qualify leads by assessing their likelihood of converting into policyholders, saving time and effort for sales teams.

Customer Engagement and Experience

- AI-powered chatbots and virtual assistants provide 24/7 support to customers, answering questions, resolving queries, and scheduling appointments.

- Personalized recommendations and tailored marketing campaigns based on customer data enhance engagement and improve the overall experience.

Underwriting and Pricing

- AI algorithms analyze complex underwriting data to assess risk factors and determine appropriate policy terms and premiums.

- Machine learning models identify patterns and correlations that may not be apparent to human underwriters, leading to more accurate risk assessments and fair pricing.

Claims Management

Artificial intelligence (AI) is transforming the insurance industry, and claims management is no exception. AI can automate many of the tasks involved in claims processing, reducing costs and improving efficiency. AI can also be used to detect and prevent fraud, and to improve customer satisfaction.

Automating Claims Processing

AI can be used to automate many of the tasks involved in claims processing, such as data entry, document review, and claims adjudication. This can free up claims adjusters to focus on more complex tasks, such as investigating claims and negotiating settlements.

- Reduced costs:AI can help insurance companies reduce costs by automating many of the tasks involved in claims processing.

- Improved efficiency:AI can help insurance companies process claims more quickly and efficiently.

- Improved accuracy:AI can help insurance companies improve the accuracy of their claims processing.

Fraud Detection and Prevention

AI can also be used to detect and prevent fraud. AI can analyze data to identify patterns that are indicative of fraud, such as unusual claims patterns or suspicious activity.

- Reduced fraud:AI can help insurance companies reduce fraud by identifying and preventing fraudulent claims.

- Improved customer satisfaction:AI can help insurance companies improve customer satisfaction by reducing the number of fraudulent claims that are filed.

Improving Customer Satisfaction

AI can also be used to improve customer satisfaction. AI can provide customers with self-service options, such as online claims filing and tracking. AI can also be used to provide customers with personalized service, such as tailored recommendations and advice.

- Increased customer satisfaction:AI can help insurance companies increase customer satisfaction by providing customers with self-service options and personalized service.

- Improved customer experience:AI can help insurance companies improve the customer experience by making it easier for customers to file and track claims.

Risk Management

AI plays a crucial role in risk management by enhancing the identification and assessment of risks. It analyzes vast amounts of data to identify patterns and correlations that are often missed by humans.

AI-powered predictive modeling and scenario planning enable insurers to anticipate future events and assess their potential impact. These models incorporate historical data, industry trends, and external factors to generate simulations and forecasts.

Catastrophe Modeling

In catastrophe modeling, AI helps insurers simulate and assess the potential impact of natural disasters, such as hurricanes, earthquakes, and floods. By analyzing historical data and using machine learning algorithms, AI can generate detailed models that estimate the likelihood and severity of catastrophic events.

Product Development

Artificial Intelligence (AI) is transforming the insurance industry, and product development is no exception. Insurers are leveraging AI to develop new and innovative products that meet the evolving needs of customers.

One of the most significant ways AI is being used in product development is through personalized product recommendations. AI algorithms can analyze customer data to identify their individual needs and preferences. This information can then be used to recommend products that are tailored to each customer’s unique risk profile and financial situation.

Usage-Based Insurance

Another area where AI is having a major impact is usage-based insurance (UBI). UBI programs use telematics devices to track customer driving behavior. This data can then be used to calculate premiums based on how safely and efficiently customers drive.

UBI programs have the potential to significantly reduce insurance costs for safe drivers while also promoting safer driving habits.

Customer Service

AI plays a significant role in enhancing customer service in the insurance industry. It enables insurers to provide faster, more efficient, and personalized experiences to their policyholders.

Chatbots and Virtual Assistants

- AI-powered chatbots and virtual assistants can provide immediate support to customers 24/7, answering common questions and resolving simple queries.

- These virtual assistants can understand natural language, making it easy for customers to interact with them.

- They can also be integrated with other systems, such as policy management systems, to provide real-time information and personalized recommendations.

Personalized Communication and Recommendations

- AI can analyze customer data, such as their policy history, demographics, and behavior, to create personalized communication and recommendations.

- This allows insurers to send relevant messages and offers to each customer, improving engagement and satisfaction.

- AI-powered recommendation engines can suggest additional coverage or services that are tailored to the customer’s specific needs.

Customer Loyalty

- AI can help insurers build customer loyalty by providing a seamless and positive experience.

- By resolving issues quickly and efficiently, answering questions accurately, and providing personalized recommendations, AI can create a strong bond between the insurer and the policyholder.

- This can lead to increased customer retention and reduced churn.

Operations

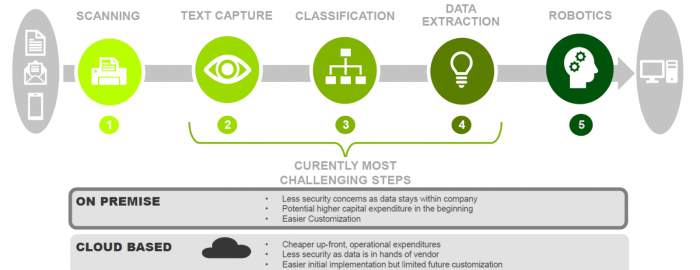

AI is transforming back-office operations in the insurance industry, enabling insurers to automate repetitive and time-consuming tasks, reduce costs, and improve operational efficiency.

Data Analytics and Reporting

AI-powered data analytics tools can help insurers gather and analyze large volumes of data from various sources, including claims, policyholder information, and market trends. This data can be used to generate insights into operational performance, identify areas for improvement, and make informed decisions.

Improved Operational Efficiency

AI can automate tasks such as data entry, document processing, and claims processing. This frees up employees to focus on more complex and value-added tasks, improving overall operational efficiency and reducing costs.

Conclusion

Integrating AI throughout the insurance value chain offers significant benefits, including enhanced customer experiences, improved operational efficiency, and reduced costs. However, challenges and opportunities coexist with AI adoption.

To effectively implement AI, insurers should consider the following recommendations:

Challenges and Opportunities

- Data Quality and Privacy:AI models rely on high-quality data. Insurers must ensure data accuracy, completeness, and compliance with privacy regulations.

- Talent and Skills:AI implementation requires specialized skills. Insurers should invest in training existing employees or hiring new talent with AI expertise.

- Regulatory Compliance:AI systems must comply with industry regulations and ethical guidelines. Insurers should establish clear policies and procedures for AI usage.

- Bias and Fairness:AI models can inherit biases from the data they are trained on. Insurers must mitigate bias to ensure fair and equitable outcomes.

- Transparency and Explainability:Insurers should provide clear explanations of how AI systems make decisions, fostering trust and understanding among stakeholders.

Recommendations for Insurers

- Start with a Clear Strategy:Define specific goals and objectives for AI adoption, aligning with the insurer’s overall business strategy.

- Focus on High-Value Use Cases:Identify areas where AI can deliver the most significant impact, such as underwriting, claims processing, or customer service.

- Build a Strong Data Foundation:Invest in data quality initiatives and establish data governance frameworks to ensure data integrity and availability.

- Develop AI Skills and Expertise:Train existing employees or hire new talent with AI knowledge and experience.

- Collaborate with InsurTechs:Partner with InsurTech companies to access innovative AI solutions and expertise.

- Monitor and Evaluate AI Performance:Regularly track and assess the performance of AI systems to identify areas for improvement and ensure alignment with business objectives.

Outcome Summary

In conclusion, the integration of AI throughout the insurance value chain offers a wealth of benefits for insurers. From enhanced sales and distribution to streamlined operations and improved customer service, AI is empowering insurers to meet the demands of the modern insurance landscape.

While challenges and opportunities coexist in the adoption of AI, insurers who embrace this technology strategically will be well-positioned to thrive in the years to come.

This guide has provided a comprehensive overview of how AI can be effectively implemented across the insurance value chain. By leveraging the insights and recommendations Artikeld herein, insurers can unlock the full potential of AI and drive transformative change within their organizations.