The convergence of cloud computing and insurance has created a transformative landscape, enabling insurers to optimize their operations, enhance customer experiences, and drive innovation. This narrative delves into the strategic alliance between insurers and cloud technology, highlighting the benefits, challenges, and success stories that have shaped this dynamic partnership.

Cloud computing has emerged as a game-changer for insurers, offering scalability, flexibility, and cost-effective solutions. By leveraging cloud platforms, insurers can streamline their IT infrastructure, reduce hardware and software costs, and enhance their agility in responding to market demands.

Cloud Power

The cloud offers insurers a multitude of benefits, including enhanced scalability, agility, and cost-effectiveness. By migrating to the cloud, insurers can access a vast pool of computing resources that can be scaled up or down as needed, allowing them to meet the fluctuating demands of their business.

Cloud computing also enables insurers to adopt a more agile approach to software development and deployment. With the cloud, insurers can quickly and easily spin up new environments for testing and development, and they can deploy new applications and updates with minimal downtime.

Challenges of Cloud Migration

While the cloud offers many benefits, there are also some challenges associated with migrating to the cloud. One of the biggest challenges is the need to re-architect existing applications to make them cloud-native. This can be a complex and time-consuming process, but it is essential for ensuring that applications can take full advantage of the cloud’s capabilities.

Another challenge of cloud migration is the need to manage security and compliance. Insurers must ensure that their data and applications are secure in the cloud, and they must also comply with all applicable regulations.

Examples of Insurers Who Have Successfully Harnessed Cloud Power

Despite the challenges, many insurers have successfully harnessed the power of the cloud. For example, Progressive Insurance has migrated its core systems to the cloud, and the company has seen a significant improvement in its scalability, agility, and cost-effectiveness.

Another example is MetLife, which has used the cloud to develop a new digital insurance platform. The platform has enabled MetLife to offer new products and services to its customers, and it has also helped the company to improve its customer service.

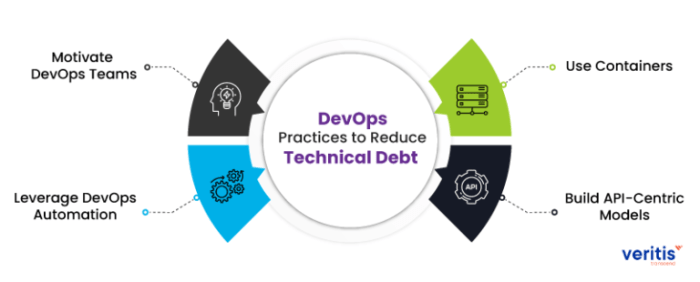

Reducing Tech Debt

Tech debt is a problem for insurers because it can lead to a number of issues, including:

- Increased costs

- Reduced efficiency

- Increased risk of outages

There are a number of strategies that insurers can use to reduce tech debt, including:

- Investing in new technology

- Refactoring existing systems

- Outsourcing IT functions

Several insurers have successfully reduced tech debt. For example, Allstate reduced its tech debt by 30% by investing in new technology and refactoring existing systems. State Farm reduced its tech debt by 20% by outsourcing IT functions.

Data Analytics

Data analytics plays a crucial role for insurers, enabling them to make informed decisions, improve underwriting accuracy, and enhance customer experiences. By leveraging data, insurers can gain insights into customer behavior, risk profiles, and market trends, which helps them tailor products and services to meet specific needs.

Challenges in Using Data Analytics

Despite its potential, the insurance industry faces several challenges in utilizing data analytics effectively. These include:

Data quality and availability

Insurers often deal with vast amounts of data from multiple sources, which can be fragmented, inconsistent, and incomplete.

Data security and privacy

Handling sensitive customer data requires robust security measures to protect against breaches and comply with regulations.

Lack of skilled professionals

The insurance industry needs professionals with expertise in data science, machine learning, and analytics to extract meaningful insights from data.

Cybersecurity

Insurers face a number of cybersecurity risks, including data breaches, ransomware attacks, and phishing scams. These attacks can result in the loss of sensitive customer data, financial losses, and reputational damage.

To protect themselves from cyberattacks, insurers can implement a number of strategies, including:

- Investing in cybersecurity technology, such as firewalls, intrusion detection systems, and anti-malware software.

- Educating employees about cybersecurity risks and best practices.

- Developing a cybersecurity incident response plan.

Examples of Insurers Who Have Successfully Implemented Cybersecurity Measures

- Allstatehas invested heavily in cybersecurity technology and has developed a comprehensive cybersecurity incident response plan.

- Progressivehas implemented a number of cybersecurity measures, including employee education and training, and has achieved ISO 27001 certification.

- State Farmhas partnered with a number of cybersecurity vendors to implement a layered security approach.

Innovation

Innovation is critical for insurers to remain competitive and meet the changing needs of their customers. By embracing new technologies and business models, insurers can improve their operational efficiency, reduce costs, and create new products and services that better meet the needs of their customers.

However, innovating in the insurance industry can be challenging. Insurers are often large, complex organizations with legacy systems and processes that can make it difficult to implement new technologies. Additionally, the insurance industry is heavily regulated, which can add to the challenges of innovation.

Examples of Insurers Innovating

Despite the challenges, a number of insurers are innovating to improve their business. For example, some insurers are using artificial intelligence (AI) to automate underwriting and claims processing. Others are using telematics to track driver behavior and offer personalized insurance rates.

And still others are partnering with insurtech startups to develop new products and services.

Conclusive Thoughts

The journey of insurers harnessing cloud power and reducing tech debt is an ongoing evolution. As the insurance industry continues to embrace digital transformation, cloud computing will remain a cornerstone of innovation and operational efficiency. Insurers that successfully navigate this landscape will be well-positioned to meet the evolving needs of their customers, drive growth, and secure their competitive edge in the years to come.