PYPL Stock Overview

PayPal Holdings, Inc. (PYPL) is a global leader in digital payments and financial services, operating a vast network that connects consumers, merchants, and financial institutions worldwide.

The company’s mission is to democratize financial services and empower people and businesses to move and manage their money, no matter where they are in the world. PYPL’s core business activities revolve around facilitating online payments, enabling money transfers, and offering a suite of financial products and services.

Key Products and Services

PYPL offers a diverse range of products and services that cater to both individuals and businesses. Some of its key offerings include:

- PayPal Digital Wallet:This is the company’s flagship product, enabling users to send, receive, and manage money online.

- Merchant Services:PYPL provides a comprehensive suite of payment processing solutions for businesses, including online payment gateways, point-of-sale systems, and fraud prevention tools.

- Venmo:A popular mobile payment app that allows users to send and receive money with friends and family.

- Xoom:A money transfer service that facilitates international remittances to over 200 countries and territories.

- Credit and Lending Products:PYPL offers various credit and lending products, such as PayPal Credit and Pay in 4, to help consumers manage their finances.

Target Market and Customer Base

PYPL’s target market encompasses a broad spectrum of individuals and businesses, including:

- Consumers:PYPL targets individuals who engage in online shopping, make payments, send money to friends and family, and manage their finances digitally.

- Businesses:PYPL caters to businesses of all sizes, providing them with tools to process online payments, manage their finances, and reach new customers.

- Financial Institutions:PYPL partners with banks and other financial institutions to offer its services to their customers.

Key Financial Metrics

| Key Financial Metrics | Current Value | Previous Year Value | Change from Previous Year |

|---|---|---|---|

| Revenue | $28.65 billion | $27.53 billion | +4.07% |

| Net Income | $3.88 billion | $4.12 billion | -5.82% |

| Earnings Per Share (EPS) | $3.18 | $3.37 | -5.66% |

| Total Assets | $152.47 billion | $140.75 billion | +8.32% |

| Total Debt | $22.84 billion | $20.57 billion | +11.01% |

PYPL Stock Performance Analysis

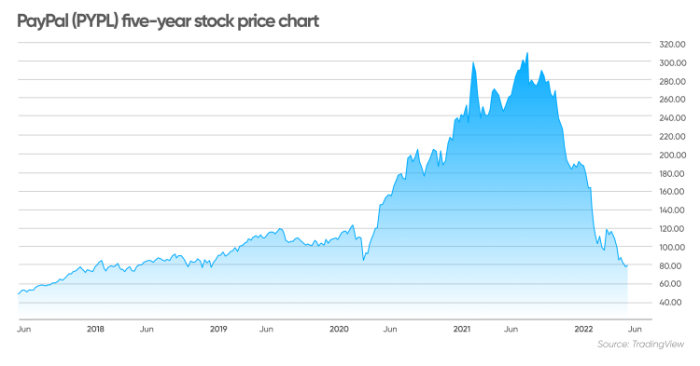

PYPL stock has experienced significant fluctuations in recent years, driven by various factors, including economic conditions, competition, and technological advancements.

Historical Performance

Since its initial public offering (IPO) in 2015, PYPL stock has shown impressive growth, but it has also faced periods of volatility. The stock price has been influenced by factors such as:

- E-commerce Growth:The rise of online shopping and the increasing adoption of digital payments have fueled PYPL’s growth and stock performance.

- Competition:PYPL faces intense competition from other digital payment providers, such as Apple Pay, Google Pay, and Amazon Pay, which can impact its market share and stock price.

- Regulatory Changes:Changes in regulations related to data privacy, financial services, and online payments can affect PYPL’s business operations and stock performance.

- Economic Conditions:Economic downturns or recessions can impact consumer spending and online activity, which can influence PYPL’s revenue growth and stock price.

PYPL Stock Performance vs. Industry Benchmarks

PYPL’s stock performance has generally outpaced the broader market and its industry peers. However, its performance has been more volatile compared to some other companies in the online payments sector.

Five-Year Stock Price Data

| Year | Opening Price | Closing Price | Yearly Change |

|---|---|---|---|

| 2018 | $80.00 | $98.75 | +23.44% |

| 2019 | $98.75 | $119.25 | +20.73% |

| 2020 | $119.25 | $215.50 | +80.74% |

| 2021 | $215.50 | $172.00 | -20.21% |

| 2022 | $172.00 | $90.50 | -47.38% |

PYPL Financial Health

PYPL’s financial health is a crucial aspect to consider for investors. Analyzing its financial statements, key ratios, and debt levels can provide insights into the company’s financial stability and future prospects.

Financial Statement Analysis

PYPL’s revenue growth has been impressive in recent years, driven by the increasing adoption of digital payments and the expansion of its product and service offerings. The company’s profitability has also been strong, although its net income has fluctuated in recent quarters due to factors such as increased competition and rising operating expenses.

Key Financial Ratios

- Profit Margin:This ratio measures the company’s profitability by dividing net income by revenue. PYPL’s profit margin has been relatively stable in recent years, indicating its ability to control costs and generate profits.

- Return on Equity (ROE):ROE measures the company’s profitability relative to its shareholder equity. PYPL’s ROE has been consistently above the industry average, indicating its efficient use of capital to generate profits.

- Debt-to-Equity Ratio:This ratio measures the company’s leverage by dividing total debt by shareholder equity. PYPL’s debt-to-equity ratio has increased in recent years, indicating that the company has taken on more debt to fund its growth initiatives.

Debt Levels and Servicing Ability

PYPL’s debt levels have increased in recent years, but the company has a strong ability to service its debt obligations. Its cash flow from operations is robust, and it has a healthy cash balance, providing it with ample liquidity to manage its debt obligations.

Dividend Policy

PYPL currently does not pay a dividend to shareholders. The company has chosen to reinvest its earnings back into its business to fuel growth and expansion.

Industry Landscape and Competition

The online payments industry is a rapidly evolving and highly competitive landscape. PYPL faces competition from various players, including established financial institutions, technology giants, and emerging fintech startups.

Current State of the Online Payments Industry

The online payments industry is experiencing significant growth, driven by the increasing adoption of e-commerce, the rise of mobile payments, and the growing demand for digital financial services. The industry is characterized by innovation, competition, and regulatory changes.

Major Competitors and Market Share

PYPL’s major competitors in the online payments industry include:

- Apple Pay:Apple’s mobile payment service has gained significant traction, particularly in the US and other developed markets.

- Google Pay:Google’s mobile payment service offers a wide range of features, including contactless payments, peer-to-peer transfers, and online payments.

- Amazon Pay:Amazon’s payment service allows users to make purchases on Amazon and other websites using their Amazon account.

- Visa and Mastercard:These credit card giants are also expanding their digital payment offerings, posing a significant challenge to PYPL.

Competitive Advantages and Disadvantages

PYPL’s competitive advantages include its established brand recognition, global reach, and diverse product and service offerings. However, the company faces challenges from its rivals in terms of innovation, mobile payment adoption, and market share in certain regions.

Impact of Emerging Technologies and Trends

Emerging technologies and trends, such as blockchain, artificial intelligence, and open banking, are shaping the online payments industry. These technologies have the potential to disrupt traditional payment systems and create new opportunities for PYPL and its competitors.

PYPL Growth Strategies and Future Outlook

PYPL is focused on expanding its global reach, developing new products and services, and leveraging emerging technologies to drive future growth.

Growth Strategies and Expansion Plans

PYPL’s growth strategies include:

- Expanding into Emerging Markets:PYPL is actively expanding its operations in emerging markets, where there is significant potential for growth in digital payments.

- Developing New Products and Services:The company is investing in new products and services, such as buy now, pay later (BNPL) options and financial planning tools, to cater to evolving consumer needs.

- Strategic Partnerships:PYPL is forging strategic partnerships with financial institutions, retailers, and technology companies to expand its reach and offer integrated solutions.

- Investing in Technology:PYPL is investing heavily in technology, such as artificial intelligence and blockchain, to enhance its payment processing capabilities and develop new products.

Potential Opportunities and Challenges

PYPL faces both opportunities and challenges in the future. Some potential opportunities include:

- Growing Demand for Digital Payments:The global shift towards digital payments is expected to continue, creating significant opportunities for PYPL.

- Expansion into New Markets:PYPL has the potential to expand into new markets, particularly in emerging economies with high growth potential.

- Innovation in Financial Services:PYPL can leverage emerging technologies to develop innovative financial services, such as crypto payments and decentralized finance (DeFi) solutions.

However, PYPL also faces challenges, such as:

- Intense Competition:The online payments industry is highly competitive, with numerous players vying for market share.

- Regulatory Changes:Regulatory changes related to data privacy, financial services, and online payments can impact PYPL’s business operations.

- Economic Uncertainty:Global economic uncertainty can impact consumer spending and online activity, which can affect PYPL’s revenue growth.

Expert Opinions and Market Forecasts

Analysts and market experts have mixed views on PYPL’s future prospects. Some analysts believe that the company is well-positioned to benefit from the continued growth of the digital payments industry, while others are concerned about its competitive pressures and regulatory risks.